The Greatest Guide To Real Estate Reno Nv

Real Estate Reno Nv Fundamentals Explained

Table of ContentsThe Ultimate Guide To Real Estate Reno NvSome Known Facts About Real Estate Reno Nv.Some Known Factual Statements About Real Estate Reno Nv How Real Estate Reno Nv can Save You Time, Stress, and Money.How Real Estate Reno Nv can Save You Time, Stress, and Money.Little Known Questions About Real Estate Reno Nv.

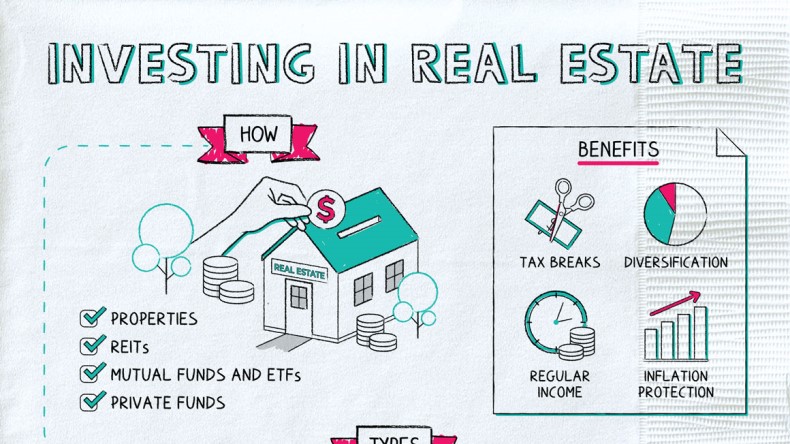

The advantages of spending in real estate are many. Below's what you require to recognize regarding genuine estate advantages and why real estate is taken into consideration a good investment.

The advantages of spending in actual estate consist of passive earnings, secure cash money circulation, tax advantages, diversity, and take advantage of. Actual estate investment depends on (REITs) supply a means to spend in genuine estate without having to possess, operate, or finance properties.

Actual estate values often tend to boost over time, and with a good financial investment, you can turn a revenue when it's time to sell. As you pay down a residential or commercial property home mortgage, you build equityan possession that's part of your web well worth. And as you build equity, you have the utilize to purchase even more homes and raise cash circulation and wide range even extra.

Realty has a lowand in some instances negativecorrelation with other significant property classes. This indicates the addition of property to a profile of varied assets can decrease portfolio volatility and offer a higher return per system of risk. Take advantage of is the usage of numerous economic instruments or borrowed capital (e.

The Only Guide for Real Estate Reno Nv

As economies increase, the demand for genuine estate drives leas greater. This, consequently, converts right into greater capital values. As a result, property often tends to preserve the acquiring power of capital by passing some of the inflationary pressure on to lessees and by including some of the inflationary stress in the kind of resources admiration.

There are several methods that having realty can protect versus rising cost of living. Residential or commercial property worths may climb higher than the price of rising cost of living, leading to funding gains. Second, rents on financial investment residential or commercial properties can boost to keep up with rising cost of living. Residential properties financed with a fixed-rate financing will certainly see the relative amount of the month-to-month home loan payments drop over time-- for circumstances $1,000 a month as a fixed repayment will end up being much less challenging as rising cost of living deteriorates the purchasing power of that $1,000.

Nonetheless, one can benefit from marketing their home at a cost higher than they spent for it. And, if this does occur, you might be liable to pay taxes on those gains. In spite of all the advantages of purchasing realty, there are disadvantages. One of the major ones is the absence of liquidity (or the relative difficulty in converting an asset into money and cash money right into a possession).

Examine This Report about Real Estate Reno Nv

Among the most basic and most common methods is just acquiring a home to rent out to others. Why spend in real estate? It needs a lot even more work than just clicking a couple of switches to spend in a mutual fund or stock. The truth is, there are numerous realty advantages that make it such a popular option for skilled investors.

The remainder goes to paying down the financing and structure equity. Equity is the worth you have in a residential or commercial property. It's the difference in between what you owe and what the home or land deserves. Gradually, regular settlements will at some point leave you possessing a home totally free and clear.

The Buzz on Real Estate Reno Nv

Anybody that's shopped or loaded their tank lately comprehends exactly how rising cost of living can damage the power of hard-earned cash money. One of one of the most underrated property advantages is that, unlike numerous typical investments, property worth has a tendency to go up, even throughout times of noteworthy rising cost of living. Like other important properties, property usually preserves worth and can for that reason operate as a superb location to spend while greater costs gnaw the gains of various other financial investments you might have.

Appreciation refers to cash made when the general worth of a possession rises between the time you acquire it and the moment you market it. Genuine estate, this can suggest significant gains due to the normally high costs of the possessions. It's critical to remember gratitude is a single thing and only provides cash when you offer, not along the method.

As discussed earlier, cash money flow is the cash that comes on a month-to-month or annual basis helpful hints as an outcome of owning the residential or commercial property. Typically, this is what's left over after paying all the required costs like home mortgage payments, repairs, taxes, and insurance. Some properties may have a considerable capital, while others might have little or none.

Real Estate Reno Nv - Questions

Brand-new financiers may not really understand the power of leverage, but those who do open the possibility for huge gains on their investments. Generally speaking, leverage in investing comes when you can have or control a bigger quantity of properties than you can otherwise spend for, click reference via using credit scores.